Introduction

The forex market is the world largest financial market. The daily trading volume exceeding $6.1 trillion. The forex market operates five days a week and 24 hours a day. This provides an opportunity for traders to participate in trading activities. For traders in the UAE, understanding the specific market opening times is crucial for optimizing trading strategies and making informed decisions. In this comprehensive guide, we will explore the forex market hours, how they translate to UAE time, and the best times for UAE traders to trade forex.

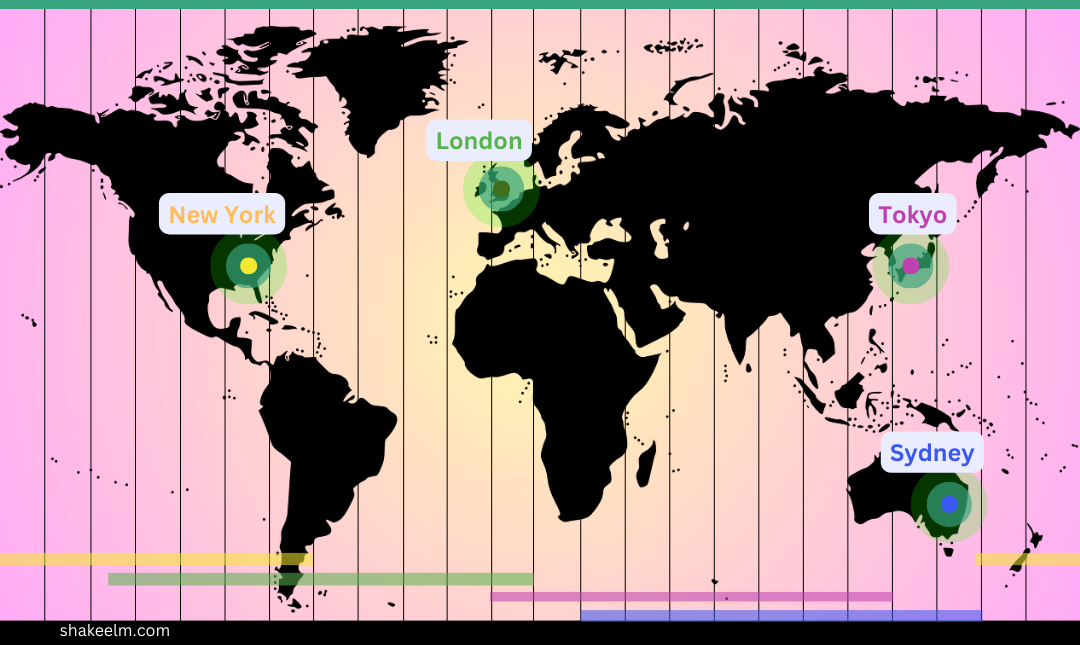

| 1am | 2am | 3am | 4am | 5am | 6am | 7am | 8am | 9am | 10am | 11am | 12pm | 1pm | 2pm | 3pm | 4pm | 5pm | 6pm | 7pm | 8pm | 9pm | 10pm | 11pm | 12am |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| S | S | S | S | S | S | S | S | S | |||||||||||||||

| T | T | T | T | T | T | T | T | T | |||||||||||||||

| L | L | L | L | L | L | L | L | L | |||||||||||||||

| NY | NY | NY | NY | NY | NY | NY | NY | NY | NY |

Forex Market Opening Times in UAE

The Forex Market operates in Dubai, UAE on Gulf Standard Time (GST), which is UTC+4. Following are the major forex trading sessions converted to GST:

- Sydney Session: 12:00 AM – 9:00 AM GST

- Tokyo Session: 3:00 AM – 12:00 PM GST

- London Session: 11:00 AM – 8:00 PM GST

- New York Session: 4:00 PM – 1:00 AM GST

Between the London and New York session, there is an overlap time from 4:00 PM to 8:00 PM GST, is particularly noteworthy. You will find higher trading volume and volatility, so in other words this will be the best times for trading forex.

Understanding Forex Market Hours

The interesting part of the forex market is that it operates from Monday to Friday because there is an overlapping trading session from different time zones. These sessions are classified based on four major trading periods:

Sydney Session:

This session starts the trading week, and you will the volatility lower compared to other sessions.

Tokyo Session:

The Asian session, dominated by Tokyo, sees increased trading volume, especially in currency pairs involving the Japanese Yen.

London Session:

The European session, centred in London, is one of the most active sessions due to the significant volume of trades.

New York Session:

The North American session, dominated by New York, overlaps with the London session and is known for high volatility and liquidity.

Each session has its own characteristics, and understanding these can help traders make better decisions.

Importance of Market Opening Times

Market opening times are essential for several reasons:

Liquidity:

Different sessions have varying levels of liquidity. Higher liquidity means tighter spreads and better trading conditions.

Volatility:

Some sessions, like the London and New York overlap, are more volatile. When there is volatility, that means it can bring an opportunity as well as higher risks for traders.

News Releases:

Economic news releases often occur during specific sessions, influencing market movements. Being aware of these timings can help traders plan their trades.

Best Timing to Trade Forex in the UAE

For traders in the Dubai, UAE, the best times to trade forex can be identified based on liquidity, volatility, and personal trading strategies. Here are some recommendations:

London and New York Overlap (4:00 PM – 8:00 PM GST):

This is the most active trading period, offering high liquidity and significant price movements. It’s ideal for traders looking for volatility and quick profits.

London Session (11:00 AM – 8:00 PM GST):

The London session alone also offers substantial trading opportunities due to its high liquidity.

Early Tokyo Session (3:00 AM – 7:00 AM GST):

For those who prefer early trading, the Tokyo session provides good opportunities, especially for trading currency pairs involving the Japanese Yen.

Trading Strategies Based on Market Hours

Understanding market hours is not just about knowing when the market is open; it’s about tailoring your trading strategies to these times. Here are a few strategies that UAE traders can consider:

Scalping During High Liquidity:

Scalping involves making small profits from numerous trades. The best time for scalping is during the London-New York overlap when liquidity is highest.

Swing Trading During Market Overlaps:

Swing traders look for larger price movements. The overlapping time between London and New York provide ample opportunities for swing trading.

News Trading:

Economic news releases can cause significant market movements. Traders should be aware of key news release times and plan their trades accordingly.

Tools and Resources for UAE Forex Traders

To maximize trading efficiency, UAE traders can use various tools and resources:

- Forex Market Clocks: Online tools that display market hours in different time zones.

- Economic Calendars: These provide schedules of economic news releases and their expected impact on the market.

- Trading Platforms with Time Zone Features: Platforms like MetaTrader 4/5 that allow customization of time zones to match GST.

Local Considerations for UAE Traders

While the forex market operates globally, local factors can influence trading activities in the UAE:

- Public Holidays: Be aware of UAE public holidays as they can affect local market participation.

- Local News: Significant local news events can impact market sentiment and should be considered in trading strategies.

Conclusion

Understanding the forex market opening times in the UAE is crucial for optimizing your trading strategy. When you are in UAE, then you should plan your trades based on the most active market hours, you can take advantage of higher liquidity and better trading opportunities. The London-New York overlap, from 4:00 PM to 8:00 PM GST, stands out as the best period for trading due to its high activity and volatility.

Additionally, employing tailored trading strategies and leveraging tools like forex market clocks and economic calendars can further enhance your trading experience. Overall keep inform with the most important topics with Shakeel and maximize your success in the forex market.

0 Comments